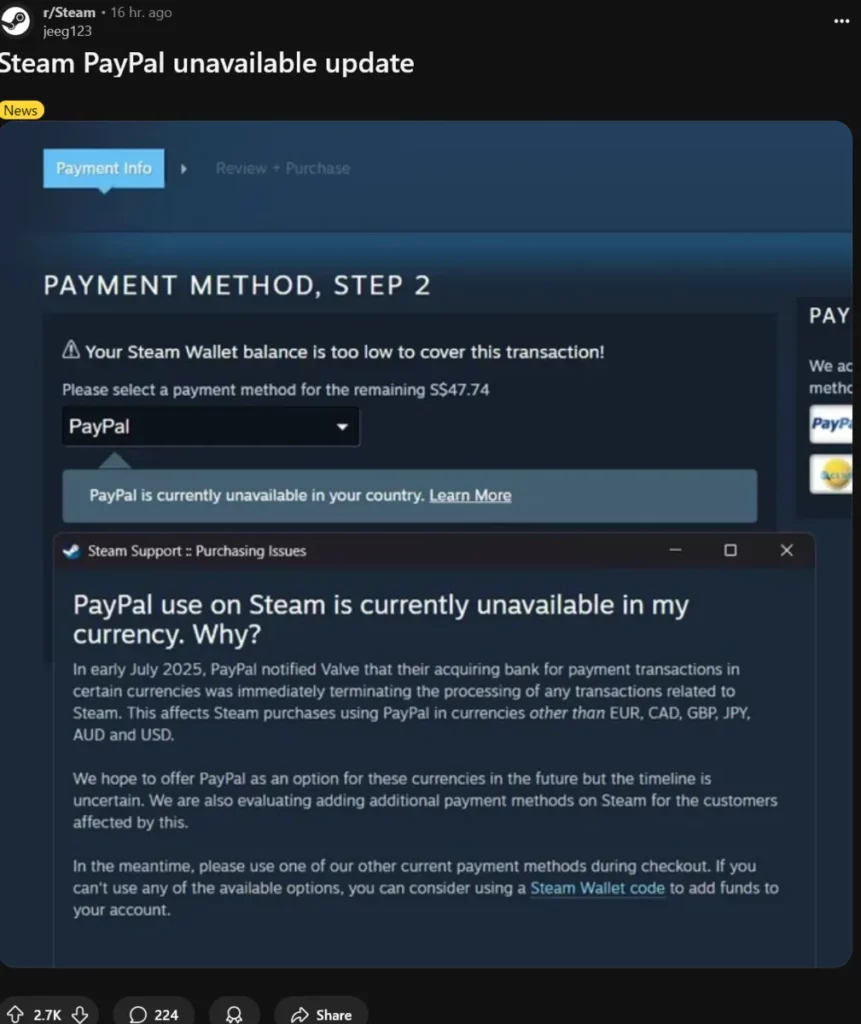

Steam players across dozens of countries have been hit with a sudden checkout roadblock: PayPal is gone. Unless you’re paying in Euros, British Pounds, Japanese Yen, Australian Dollars, Canadian Dollars, or U.S. Dollars, the once-simple one-click option has vanished — and Valve isn’t saying when it might return.

Currency, not content, is the culprit

Valve confirmed the change stems from one of PayPal’s acquiring banks halting Steam transactions in a long list of currencies. That means countries like Brazil, Poland, Norway, Mexico, Switzerland, and many smaller markets have been cut off, representing millions of users. Even EU nations that don’t use the Euro aren’t spared.

The scale of the disruption

Brazil alone counts nearly five million Steam accounts — all now forced to switch payment methods. Previous PayPal hiccups on Steam were typically brief or limited to specific regions. This one ranks among the largest interruptions in years, breaking a key link for players who relied on PayPal for speed and convenience.

Steam’s alternatives aren’t as smooth

Valve is pushing users toward other options, including credit cards, local payment providers, or topping up via Steam Wallet codes. While functional, they lack the instant familiarity of PayPal’s process, especially in countries where PayPal dominates online transactions.

Speculation and pushback

Some gamers initially linked the change to earlier payment processor controversies over Steam’s adult content catalog. Valve says that’s not the case here — it’s a currency-specific issue. Still, frustration is mounting, with players calling for transparency and faster action.

Waiting for a timeline from Steam that may not come

Valve has promised to explore restoring PayPal access in affected regions, but says there’s no set timeline. For now, millions are navigating clunkier payment routes, underscoring just how dependent gaming platforms are on global financial networks — and how quickly one bank’s decision can upend them.

The checkout may be digital, but the pain is real.