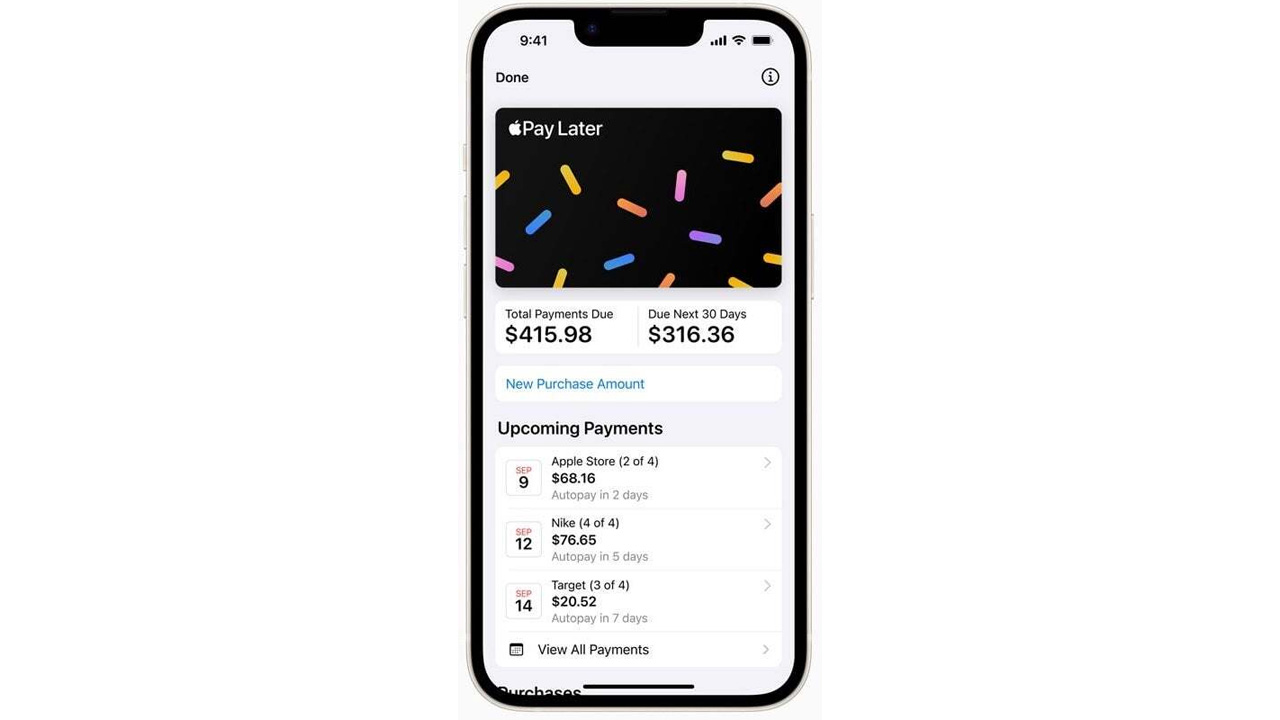

As of today, Apple has discontinued the Apple Pay Later service it launched last year. The service allowed users to borrow between $50 and $1,000 and repay that debt interest-free in four equal installments over six weeks.

Apple Pay Later new installment payment system will be available by the end of the year

Apple announced that it is working on a new installment payment system that will be available by the end of the year. In a statement, the company shared details about the new installment payment system that will replace Apple Pay Later.

The new system will allow Apple Pay users to pay in installments via credit and debit cards. In addition, this service will be available in many countries around the world.

Apple also announced the countries where the new installment payment system will be available. Later this year, it will be available through major banks such as ANZ in Australia, CaixaBank in Spain, HSBC and Monzo in the UK, and Citi and Synchrony in the US. US users will also be able to apply for credit directly through Affirm when paying with Apple Pay.

The new system will give users more flexibility and choice for online and in-app purchases. Users will be able to view and redeem rewards and see installment payment offers from eligible credit or debit cards. These features will be integrated and offered in supported markets by Apple Pay-supported banks and lenders.

It has been just 447 days since Apple Pay Later launched. However, it took just eight months from last October, when the service was fully rolled out, to shut down. Apple decided to make this change because the new installment payment system appeals to a wider range of users and is available in more countries.