Artificial intelligence is increasingly playing a role in the investment world. Just three years after ChatGPT’s launch, at least one in ten retail investors is using chatbots like these for stock selection.

ChatGPT provides investment advice

This interest is driving significant growth in the robo-advisory sector. This sector’s revenue is expected to reach approximately $470 billion by 2029. Surveys also show that investor interest in AI is rapidly increasing. According to eToro’s survey of 11,000 investors worldwide, nearly half are considering using AI tools, while 13 percent are already using them.

A UK-based Finder study reveals that 40 percent of respondents have tried chatbots like ChatGPT and Gemini for financial advice. However, experts warn that generative AI models can produce inaccurate figures, rely too heavily on past price movements, or make inaccurate predictions about the future.

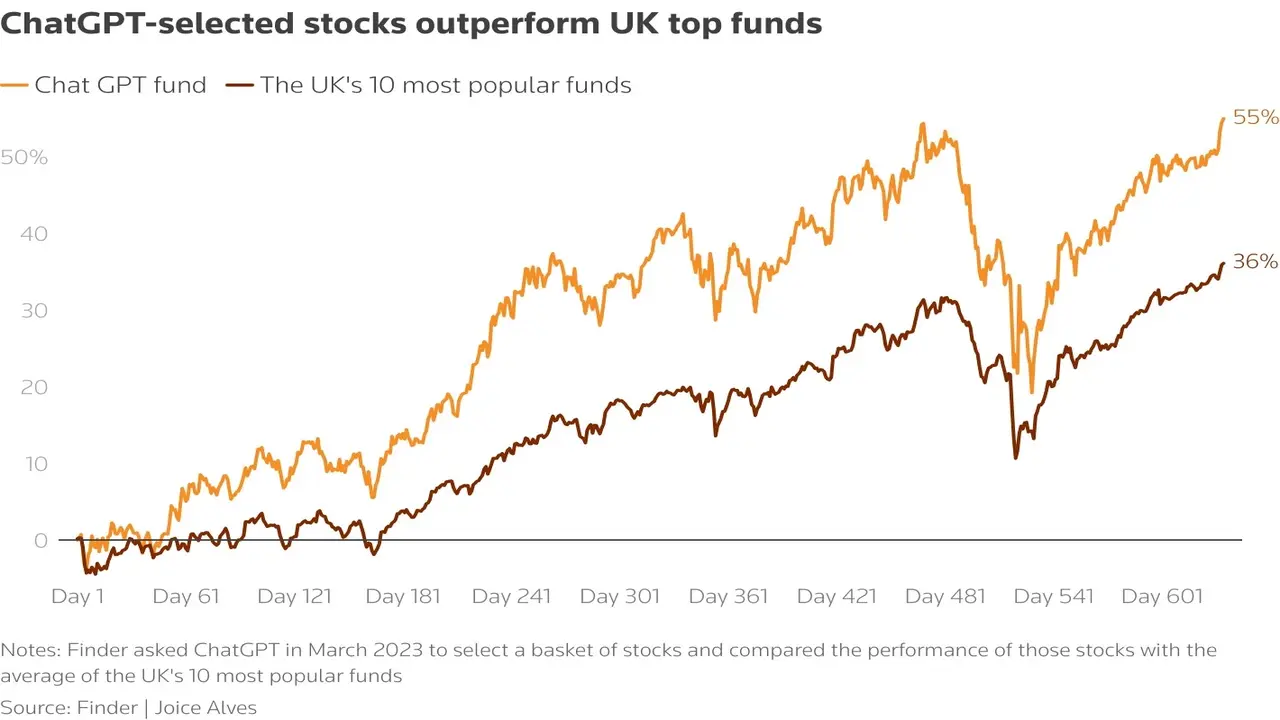

There are also successful examples of these tools. In March 2023, Finder asked ChatGPT to create a basket of stocks based on specific criteria. These criteria included companies with low debt levels, sustainable growth, and competitive advantages.

Among the 38 stocks selected by ChatGPT were major companies such as Nvidia, Amazon, Procter & Gamble, and Walmart. This basket has gained 55% to date, 19 percentage points higher than the average of the UK’s 10 most popular funds.

Experts note that investing with AI carries high risks and requires financial knowledge. Even when using ChatGPT or similar tools, they say adding additional details to questions like “Think like a short analyst” or “Conduct analysis based solely on SEC filings” will yield better results.