China has imposed new restrictions on the export of LFP battery technology, which is widely used in electric vehicles and energy storage systems. With the new regulation implemented by the Chinese Ministry of Commerce, lithium iron phosphate (LFP) and related cathode production technologies are now subject to export licenses.

China Imposes Export Restrictions on LFP Battery Technology

The published decision covers the production processes of lithium manganese iron phosphate (LMFP) and other phosphate-based cathode raw materials, as well as LFP. These technologies are among the key components in lithium-ion battery production. According to the decision, manufacturers and exporters wishing to export these technologies abroad must obtain special permission from the Chinese government. Exports are not permitted without a license.

Exports of LFP and LMFP technologies are not completely banned. However, these technologies are now classified as “export restricted,” meaning that export activities may be suspended unless a license is obtained. The Chinese Ministry of Commerce announced that procedures will be improved to make the licensing process more efficient and that companies will be informed of the new regulations.

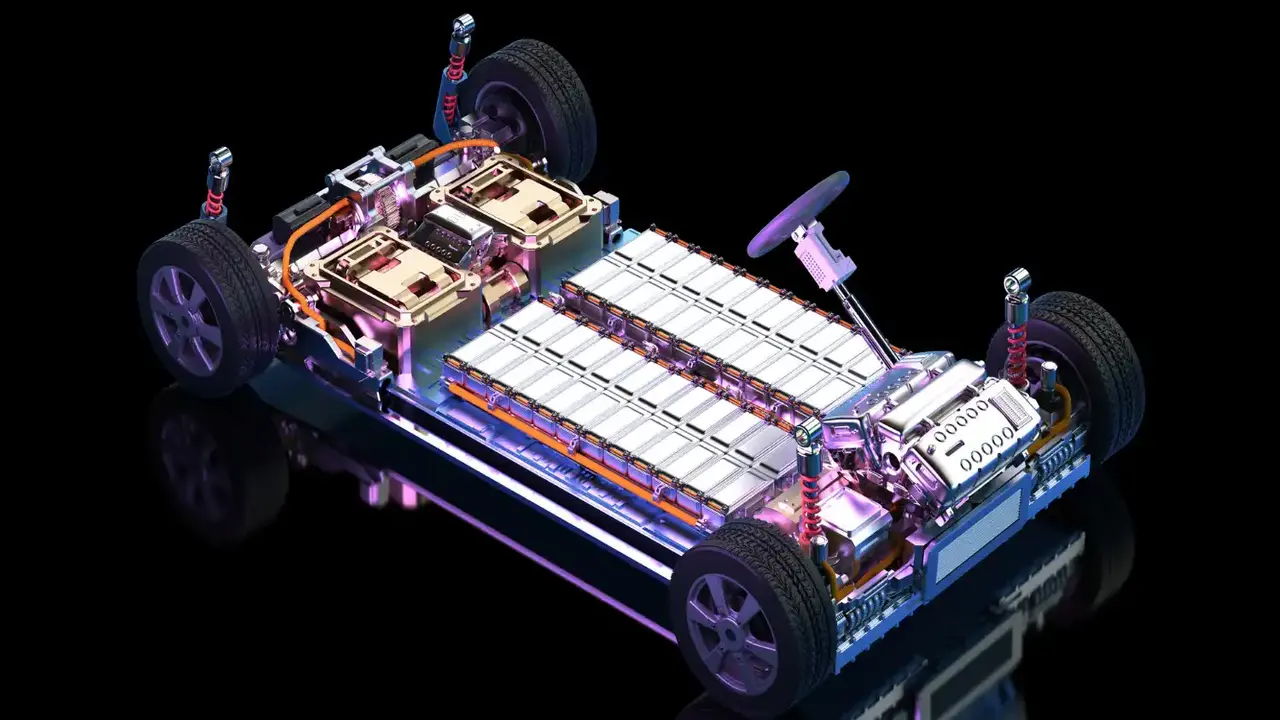

China, which holds a large share of the global electric vehicle market, has long held a leading position in LFP battery production. Chinese manufacturers have offset some energy density disadvantages by increasing the charging speed of the cells through advancements in LFP technology. These developments have led to increased demand for LFP cells, particularly in the affordable electric vehicle segment.

In Europe, automakers, who once focused on NMC (nickel-manganese-cobalt) cells, which offer higher energy density, have increasingly favored LFP cells in recent years due to their cost advantages and improved performance.

However, the fact that most of the cathode materials and precursor chemicals used in LFP cell production are still based on Chinese technologies makes global manufacturers more dependent on a tighter supply relationship with China.

The new export regulation could directly impact not only China-based companies but also automakers and battery developers outside of China. For Western companies, in particular, attempting to relocate battery cell production to their home country, this decision means additional bureaucratic processes for accessing the technology. With this move, China maintains control of this strategically important battery technology.